The Best Guide To Mileagewise - Reconstructing Mileage Logs

Table of ContentsMileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneThe Mileagewise - Reconstructing Mileage Logs IdeasSome Known Facts About Mileagewise - Reconstructing Mileage Logs.Some Known Details About Mileagewise - Reconstructing Mileage Logs The Definitive Guide for Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs for BeginnersThe Mileagewise - Reconstructing Mileage Logs Ideas

Timeero's Fastest Range attribute recommends the shortest driving path to your staff members' destination. This feature boosts efficiency and adds to cost savings, making it a necessary asset for companies with a mobile labor force. Timeero's Suggested Course feature additionally improves responsibility and performance. Workers can contrast the recommended path with the real course taken.Such an approach to reporting and conformity simplifies the usually complicated task of managing gas mileage costs. There are many advantages linked with utilizing Timeero to keep track of gas mileage.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

These added verification actions will maintain the IRS from having a reason to object your mileage documents. With accurate mileage monitoring innovation, your staff members don't have to make harsh gas mileage estimates or also worry concerning mileage expense tracking.

For instance, if a worker drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all automobile expenditures. You will need to continue tracking mileage for work even if you're using the actual cost technique. Maintaining gas mileage documents is the only way to separate organization and individual miles and provide the proof to the IRS

Many mileage trackers let you log your journeys manually while computing the range and reimbursement amounts for you. Numerous likewise included real-time trip tracking - you require to begin the app at the beginning of your journey and stop it when you reach your last location. These apps log your start and end addresses, and time stamps, together with the total distance and compensation quantity.

The Definitive Guide for Mileagewise - Reconstructing Mileage Logs

This consists of costs such as fuel, maintenance, insurance policy, and the car's depreciation. For these expenses to be considered insurance deductible, the automobile must be made use of for organization purposes.

Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

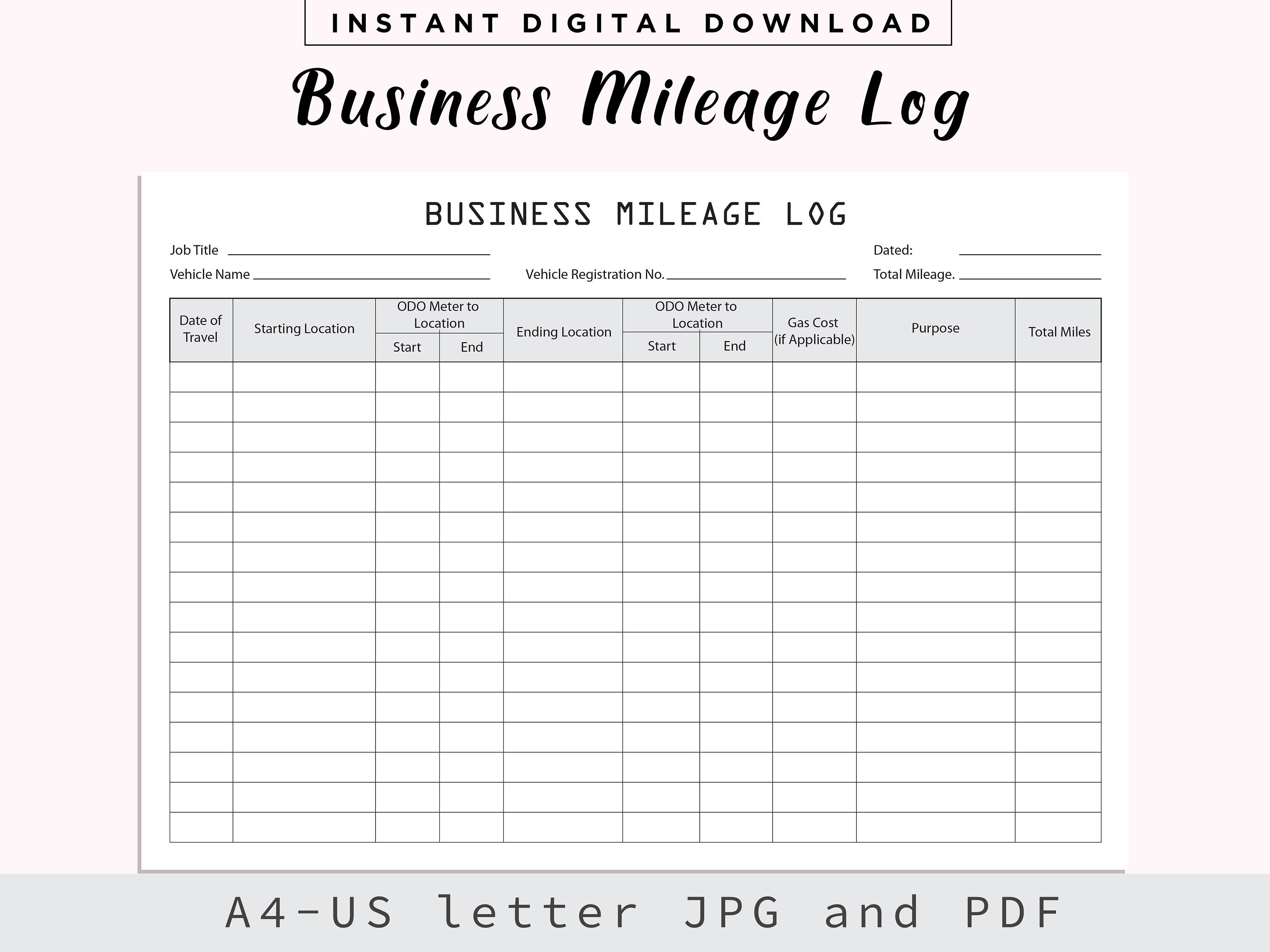

In between, faithfully track all your service trips noting down the beginning and ending analyses. For each trip, document the location and organization purpose.

This consists of the overall organization gas mileage and complete mileage accumulation for the year (business + personal), trip's date, destination, and objective. It's essential to videotape tasks quickly and keep a synchronic driving log outlining day, miles driven, and company purpose. Right here's just how you can improve record-keeping for audit objectives: Beginning with making certain a careful mileage log for all read what he said business-related travel.

The Definitive Guide to Mileagewise - Reconstructing Mileage Logs

The actual costs technique is an alternate to the typical gas mileage rate method. Rather of calculating your deduction based on a fixed rate per mile, the actual costs technique enables you to deduct the real costs connected with using your car for business objectives - free mileage tracker app. These costs include fuel, upkeep, repair services, insurance policy, devaluation, and other related expenses

Those with considerable vehicle-related expenditures or distinct problems might profit from the actual expenses method. Inevitably, your selected approach needs to straighten with your details economic objectives and tax scenario.

Not known Details About Mileagewise - Reconstructing Mileage Logs

Maintaining track of your mileage manually can need diligence, yet bear in mind, it might conserve you cash on your tax obligations. Tape-record the total mileage driven.

The Of Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline industry came to be the initial business users of GPS. By the 2000s, the delivery market had embraced GPS to track plans. And currently nearly every person utilizes GPS to obtain about. That implies nearly everyone can be tracked as they set about their organization. And there's snag.

Comments on “The Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs”